The potential for the Indian spice processing industry was always encouraging high in the pre-pandemic era, with its value chain stretching from the main production hubs to the international spice trade network spread across the world. And then out of the blue the COVID 19 struck, bringing the accelerating wheel of prosperity to an unprecedented grinding halt. So, although it has a promising picture in terms of its potential to prosper the challenges to reach that pinnacle, are great.

It is interesting to understand how the present pandemic scenario has changed the trend of growth in this industry. How it actually now offers an opportunity like never before, to avail more efficient technologies as well as superior quality of produce and product that open avenues to tap the global market.

Market Facts

India’s status where spice production matters is impressive enough making India the world’s top exporter of chilli, cumin and turmeric.

The stakeholders in the spice sector spread across the globed woke up to fact that the post-COVID19 period would now have new rules of operation that would have emerged naturally out of the chaos caused by the pandemic. Like in all other sectors, leveraging technology and introducing procedural changes would be key to overcoming the setback and getting back on track.

The Asia Pacific dominated the seasoning and spices market with a share of 35% in 2019. This was attributable to the rising demand for ethnic flavoured foods in countries including China and India. However, just as they are the leaders, China and India have been hit the hardest during the lockdowns imposed globally.

The global seasoning and spices market size was valued at USD 13.77 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 6.3% from 2020 to 2027. Increasing buyers’ willingness to pay a premium for cross-cultural flavours and ethnic tastes has been creating demand for ethnic products, in turn, fuelling the growth of the market. Europe is the largest market followed by North America.

Development of new demands and emerging trends

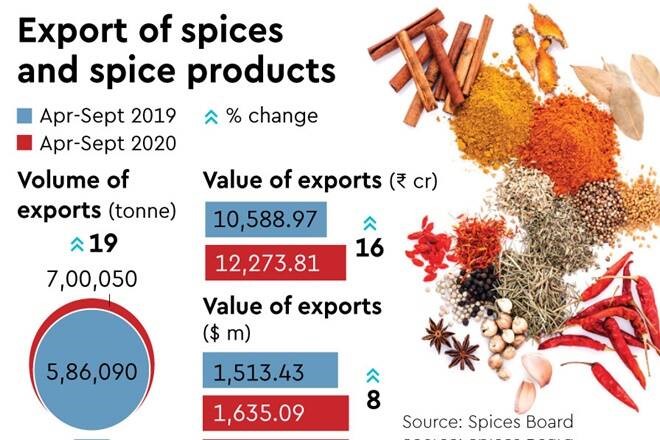

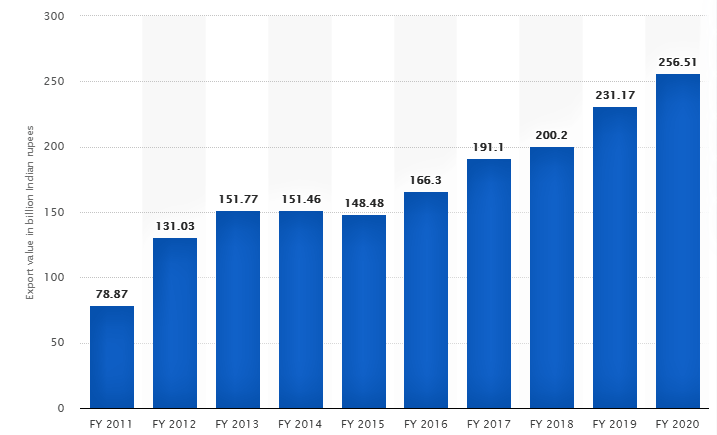

Statistica shares the estimated production volume of spices in India in financial year 2020, by type (in 1,000 metric tons). Chilly was the most exported spice from India in fiscal year 2020, with an estimated volume of over 484 thousand metric tons. Cumin followed, while turmeric ranked third. India spice exports accounted for over one million metric tons and 2.1 billion U.S. dollars in value last year.

The onset and on-going scenario of the COVID19 pandemic escalated the awareness about the consumption of the spices as immunity boosters and supplements. There has been a surging demand for pepper, cinnamon, cardamom, ginger, turmeric, cloves etc. in the Indian market. Significant growth in the food processing industry along with hectic work schedules and modern lifestyles of the general population are factors propelling the demand for Convenience food options. The immune booster smoothies too that have become trendy are incomplete without the blends of super spices like ginger, turmeric, cinnamon and mint in some cases. The penetration of such products is deep, even in the rural areas of the country. As a result, the growing utilization of spices in processed and ready-to-eat food products is further driving the market growth in the country.

An emerging trend observed is branding of the usual products highlighting their special ingredients or flavours to boost consumption and its market. Green teas now come in a range of flavours from cinnamon and ginger. Readymade spice mixes are available as ‘kadha’ sachets for routine use under the promotional banner of being immunity boosters. The trend has percolated for oils and extracts of spices along with its applications to brand health, dental and beauty care products.

Srilanka, Bangladesh and the Middle East are the areas to focus as surging producers and markets in the APAC region. More stringent standards like the FDA, BRC certification for compliance will be the hallmark for acceptable quality.

Government initiatives

Governing bodies are more cognizant about the standards to comply with when it comes to shelf life and quality, purity and nutritional value of the product range. This in turn challenges technology and overall solution providers to come up with treatments and processes that will help producers to match the global standards and promote the production and exports. The Spice Board envisages export figures of $5 billion by 2025 and is putting in every possible effort to support the entire chain from produce to process.

To give an impetus to advance in this direction incentives and liberalisation of the agricultural sector have now been announced, under which the spice industry is expected to benefit from the 20 Crore package announced for the MSME units as well as the for the agriculture sector.

Getting there…

The pressure to conserve energy, resources and the environment is high. This poses a challenge to the technology providers to explore and experiment constantly with their pilot plants, to put reliable and consistent inclusive solutions on the table to produce such quality. This relentless effort is gradually paying off with equipment with higher capacities, efficiencies and outputs, available now. The future growth for this industry is a highway of developments and progress, beyond anything we can imagine.